Powertrain forecast to 2030: Navigating the road to electrification

Download this report for forecasts of eight different powertrains across major regions, including hybridisation, electrification and internal combustion engines, which reveal changes that will have big implications for automotive design. The latest insight by the business intelligence unit of Automotive from Ultima Media

The next decade will be an electrifying one for the automotive industry. A combination of stricter environmental policies, declining battery costs and developing technologies will see hybrid and electric powertrains overtake the internal combustion engine (ICE) powered purely by petrol or diesel.

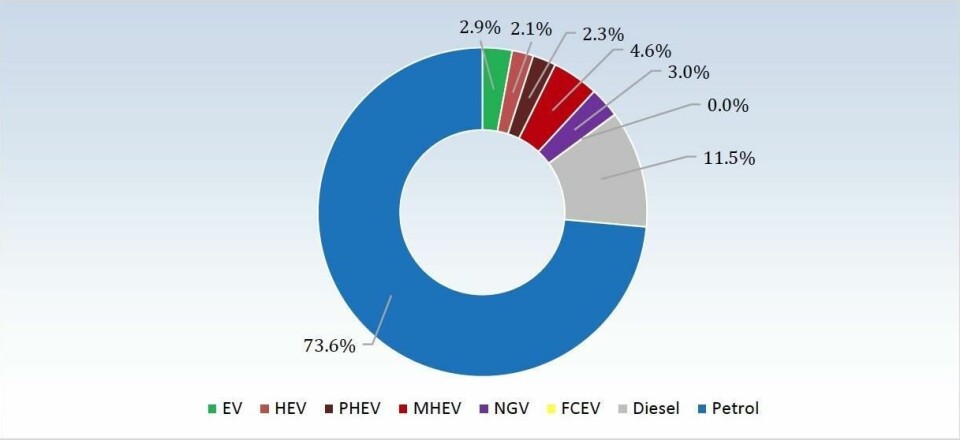

According to the latest forecast and report by Automotive from Ultima Media, the market share of new vehicles with hybrid or electric powertrains will rise dramatically from around 8% today, to 55% by 2030. Pure petrol and especially diesel-based powertrains will see double-digit declines over the decade.

However, the rate of regional adoption will vary according to regulatory differences, purchase subsidies, charging infrastructure and consumer preferences. In both Europe and China, sales of fully electric powertrains are forecasted to increase nearly sevenfold by 2030. In the US, looser environmental policy and lower population density will lead to a lower market share for electric vehicles and a greater role for petrol ICEs than other major regions.

As the report outlines, these changes present tremendous opportunities across the value chain. They will transform vehicle engineering and design, ushering in new powertrain and material technology from tier one suppliers, battery manufacturers and startups. They will also create new manufacturing and supply chain locations, along with refuelling, service and distributor centres.

But the charge to electrification brings great risk. Regional divergence in government policy will increase R&D, production and supply chain costs, complicating economies of scale and ROI for OEMs. Significant declines in petrol and diesel powertrains will also threaten many existing plants and suppliers.

Consumers, meanwhile, are faced with a confusing range of hybrid and electric options, from ‘mild’ to ‘plug-in’ to pure electric and beyond to fuel cells; many may be slower to recognise the benefits of such powertrains than regulations require.

This extremely complex landscape is explored at length in this report, including detailed forecasts, definitions and analysis by powertrain type, by region and major markets. It also provides insight on regulations and analyses implications for OEMs and tier suppliers.

Download this free, 50+ page report which includes:

Global powertrain forecast by type to 2030

- Petrol vehicle forecast

- Diesel vehicle forecast

- 48V/mild hybrid electric vehicle forecast

- Full hybrid electric vehicles forecast

- Plug-in hybrid electric vehicles forecast

- Electric vehicle forecast

- Fuel cell electric vehicles forecast

- Natural gas vehicles forecast

Powertrain forecast in eight major regions to 2030

- US powertrain forecast by type

- Rest of North America powertrain forecast by type

- Europe powertrain forecast by type

- China powertrain forecast by type

- Japan powertrain forecast by type

- Rest of APAC and Oceania powertrain forecast by type

- Central and South America powertrain forecast by type

- Middle East and Africa powertrain forecast by type

Analysis of

- Regional differences

- Investment risk

- Technological risk

- Opportunities for suppliers, startups and synergies