Future Mobility

Driving transformation

As China backs industrial strategy and the West bets on tech disruptors, the race to define the future of mobility intensifies, where autonomy, ownership, and identity are all up for grabs

‘Other Bets’ vs industrial strategy: this is the essence of the difference between US and China markets as they look to the future of mobility. ‘Other Bets’ is a unit of Alphabet, and home to Waymo, products of free-market enterprise as investors place bets on the future. Conversely China’s top-down industrial strategy provides a clear roadmap for investment. Both are shaping the way we move as the conventional business of making cars is upturned.

Around $230 billion has been invested by China to produce low-cost high-value EVs. Of the 400 companies kick-started by state subsidies in 2015, fewer than half have survived and are now locked in a price war, with deeper consolidation expected. The rapidly maturing Chinese marketplace is in effect closing the door to foreign imports, while the wave of Chinese cars sold in Western markets has only just begun. In the words of Maxime Picat, COO China, Stellantis: “Western car brands may not have a future in China as local carmakers close in on the last strongholds held by the likes of VW and Toyota.”

As BYD lines up its own fleet of carriers to import €23k EVs to Europe, Picat might also ask whether Western car brands have a future in the West.

The conventional methods of ownership are changing too, as the debate shifts from EVs to the impact of autonomous vehicles (AVs). A decade ago, carmakers were exploring on-demand mobility (ODM), as trials with car sharing schemes such as DriveNow provided behavioural data from drivers sharing existing products. This was gradually being incorporated into product definitions for new shared mobility concepts, such as the 2017 Jaguar Future-Type Concept.

But just as we approached the diffusion gap between leaders and adopters, the pandemic struck, and suddenly we weren’t so keen to share spaces any more, and premium brands decided that sharing was for the mainstream: they would continue to focus on high-margin ownership models instead. The last Jaguar concept was the explicitly not-for-sharing Type 00.

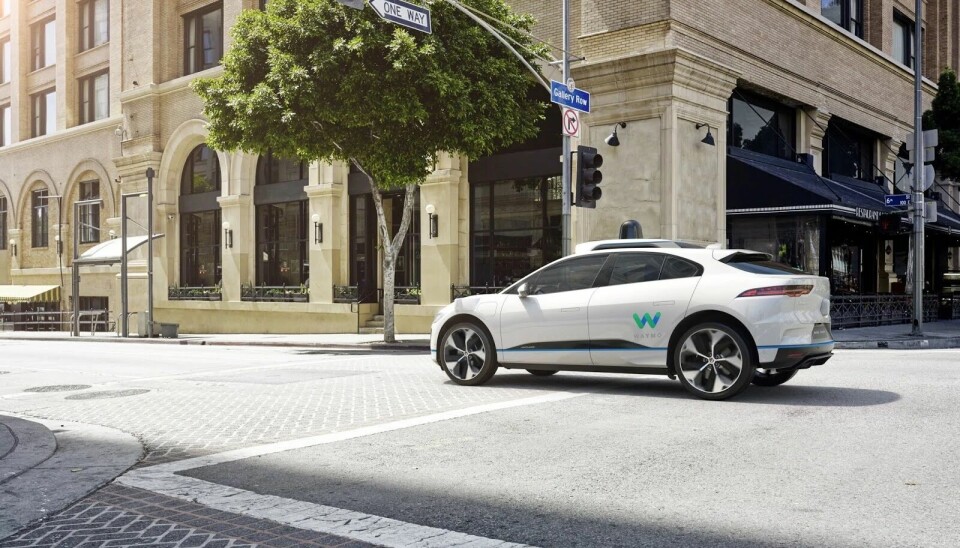

But now autonomous technology has caught up with the concept, and it is no longer carmakers who are in the driving seat. Waymo, Amazon, Baidu, Uber all have eyes on mobility, as the narrative shifts from units sold to trips made. Jaguar is now partnered with Waymo, as they complete its 10 millionth journey in an I-Pace, with prices undercutting conventional taxis with drivers.

Amazon’s move into mobility is also bearing fruit as self-driving Zoox scales up production for next year, accelerating plans for a commercial roll-out of its robotaxis in the US. It will not only be designed in California but made there too, bypassing punitive tariffs. It will be joined by Tesla’s Cybercabs as mass production begins in earnest next year, with forecasts of 10 million AVs on the road by 2030. As stated by Uber CEO Dana Khosrowshahi, autonomous vehicle technology is the “single greatest opportunity ahead for Uber”.

Such bullishness belies the fact that revenue from the robotaxi sector has fallen year-on-year, as public opinion polls show waning support for AVs, each crash another drop in ratings. It is already enough to have put on ice GM’s Cruise Origin project. Despite increasing trips, Waymo has yet to turn a profit, as the company eyes private ownership in “proving out that it can be a profitable business”, according to CEO Tekedra Mawakana. She explains that the paid trips “represent people really integrating Waymo Driver into their daily lives”, as the US company does the hard work of finding a sustainable business model.

Mawakana’s comment is telling: behind technology, every business problem is a human problem. Understanding how people behave is key to providing products they will use, and the ‘stickiness’ that keeps customers returning to brands and services. By implication, ethnographics plays a large part of this. Western societies tend to be highly individualistic and control orientated, seeing themselves as unique beings. This is a primary motivator for premium and luxury brands that are defined by symbols and rituals that flatter the individual, whereas non-western societies focus on kinship and community roles. In essence, western brands place the product on the pedestal; non-western companies build an ecosystem around the user.

This is one factor being addressed by Woven, by Toyota Inc, which was conceived as a dedicated research space. Following a restructuring in 2023 it is now responsible for developing future generations of Toyota’s operating system, called Arene. Built near the base of Mount Fuji, Woven has about 100 residents to test Toyota’s self-driving vehicle, drones and robots, such as the e-Palette concept.

This not only trains for safety scenarios, it gets to the root of product innovation where real user needs can be identified to define fit-for-purpose mobility concepts. To build a city to observe users to discover new products and services means that, like Waymo, Woven is not yet profitable. But as an arena that validates new value propositions, it could be the cornerstone to Toyota’s future success.

By contrast, China’s latest move into eVTOLs comes less from user research, but rather expansionist infrastructure as much for mobility as for employment, as the state creates new roles for workers to fill. This puts pressure on China’s businesses to find sellable products that are profitable beyond subsidies. DiDi, which has 80% of the rail-hailing market, is now partnered with GAC Aion to provide self-driving taxis; the expansion into GAC’s GOVY eVTOL brand seems assured.

Western brands have enough to take care of without contemplating flying cars. Product portfolios are already complex as technology, topology, market, brand and service converge. In 2021, Renault Group launched Mobilize as a standalone mobility brand, including car-sharing, ride-hailing, EV charging infrastructure, battery services, and energy management, alongside all their existing activities in commercial and passenger vehicles.

Their aim is to generate 20% of Renault’s revenue by 2030 through services rather than traditional vehicle sales. Implicit to Mobilize’s and Waymo’s operational efficiency is conveying the most people with the least number of vehicles possible – the complete flip to the current sales model. This neatly takes them in line with the European Commission’s ‘Sustainable and Smart Mobility Strategy’, which aims to deliver a 90% cut to mobility emissions by 2050.

Autonomous technology is already changing vehicle topologies that will have profound impact. However not everything needs to change all at once. Existing body-styles that adopt L4-5 technology will have an important role to play, where their familiarity and mature safety protocols can engender the trust currently missing in AVs. However if Western carmakers are to keep pace with a multi-modal world, they must also leverage their brand equity for new mobility offers. Those pre-pandemic ODM concepts might be worth dusting off.