General Motors and Bollinger introduce new EV platforms

EV startup’s new platform now faces growing competition from large OEMs

Electric car platforms – ‘skateboards’ and their variants – have become an interesting topic of discussion in design and engineering circles in the past six months, as licensing and marketing have drawn even, and in some cases surpassed, the chatter about engineering advancements that have dominated the headlines in the past few years.

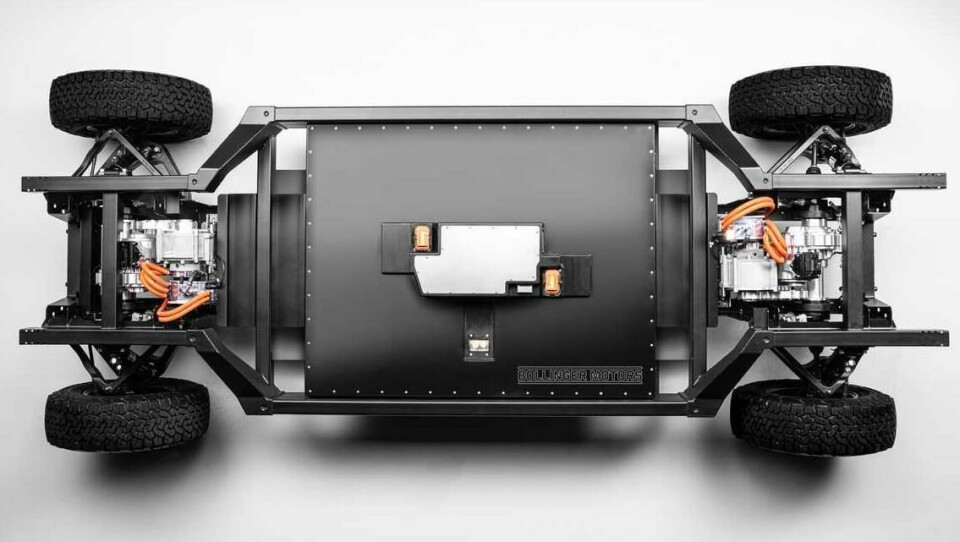

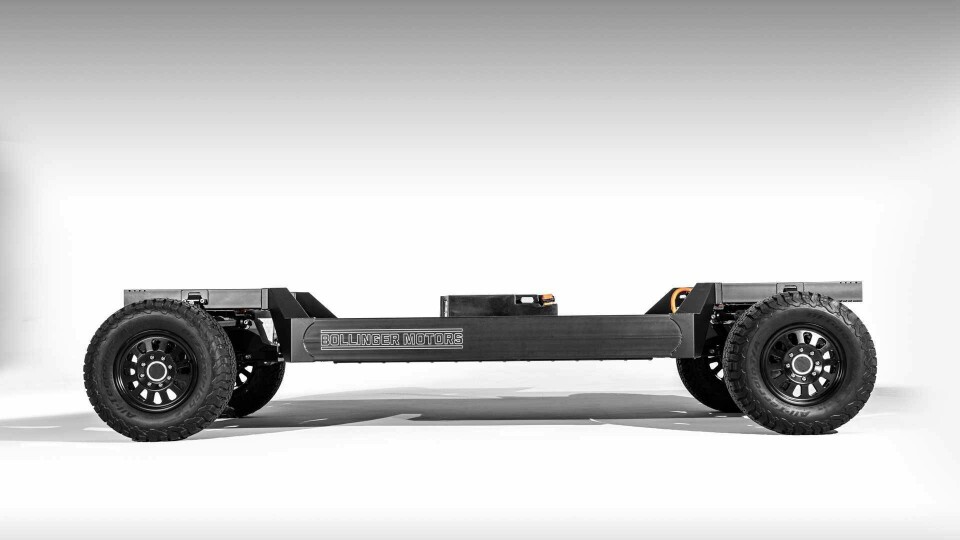

Bollinger, the Detroit-based electric truck startup, has decided to market its “E-chassis” skateboard to anyone who would like to purchase one (or a thousand) to use as a foundation for a Class 3 truck or other uses like an ambulance or perhaps a small fire engine.

Bollinger’s latest move underscores the trend in the startup electric vehicle space: Develop an advanced electric vehicle chassis and license it to OEMs or other entities to develop electric vehicle fleets. It allows startup to maintain the cash they need to establish themselves in the market, while energising electric vehicle programs of more established automakers.

Recently Los Angeles-based Canoo announced an alliance with Hyundai to develop electric vehicle architecture for A- and B-segment cars based on its bespoke – and very advanced – skateboard platform. Karma Automotive has made a similar pitch to other automakers. Developing advanced vehicle architecture and licensing it has been a stated part of the company’s core business model since its inception.

Of course, the standard bearer for this business approach is Rivian, which has alliances with Ford and Amazon, as well as developing its own SUV and truck. Rivian is reportedly developing an electric vehicle for Lincoln and is partnering with Amazon to develop a new generation of delivery trucks for the online colossus.

The Bollinger E-chassis is not designed to compete with Canoo or Rivian; it is after larger Class 3 vehicles, with gross vehicle weights of 10,000-14,000lbs (4536-6350kg). This market, dominated by box trucks and vehicles built on the Ford F-350 chassis among others, is relatively undeveloped as an EV market, although the Rivian/Amazon partnership may spark a trend in that direction.

There is good reason for this. Expensive airbags, vehicle safety systems, crash testing and so forth are not required in this class of vehicles, so costs can be reduced and creative variations can be built.

The E-chassis shown in Bollinger photos seems different from the one shown at introduction some three years ago, and this may reflect the advancing of technology and perhaps a redesign to facilitate the addition of different vehicle body types.

– Bollinger’s E-Chassis now (first image) compared to the 2017 version

But the powerful and torque-y electric powertrain remains with a 120kWh battery pack, 614 horsepower and 668lb/ft of torque. An extended wheelbase version of the chassis will be available with a massive 180kWh battery pack. Both chassis versions will come in two- or four- wheel drive. Both have a 5000lb load capacity.

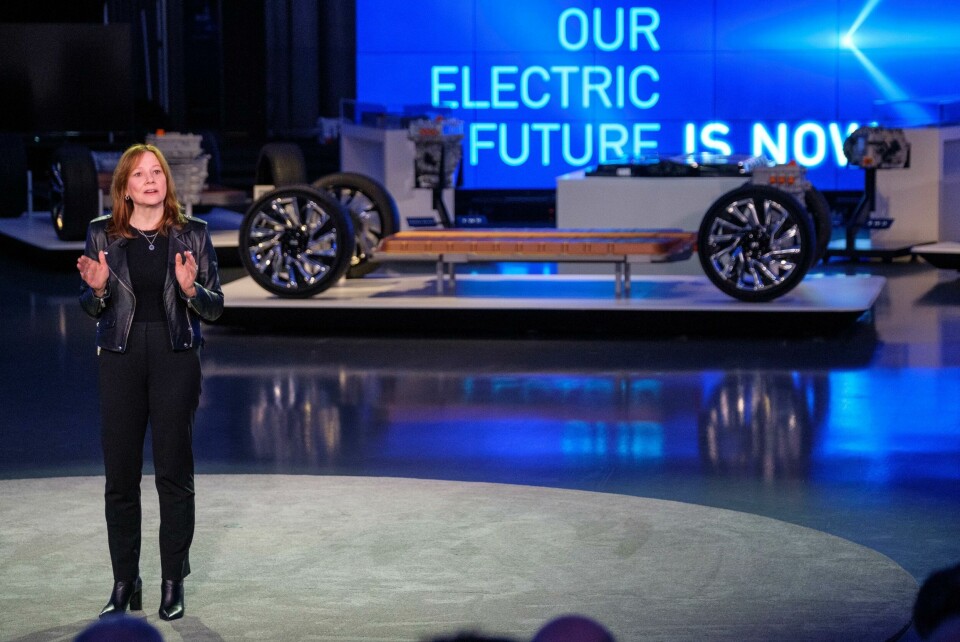

But time may not be on Bollinger’s side. Certainly, it has a unique product, but OEMs are increasingly developing their own electric platforms. Witness GM’s recent EV Day event in which introduced its own electric platform and a new type of battery called ‘Ultium’. GM also previewed some of the cars/SUVs it will underpin, from Chevrolet SUVs to the ultra-sleek Cadillac Cintiq (sadly, no photos allowed).

GM’s new platform is a suite of electric modules – battery packs and electric motors – that can be installed in both unibody cars and body-on-frame vehicles, all of various sizes. The platform, which does not have a formal name, is not a skateboard, but an adaptable system which GM maintains will be better in the long run for their mix of future offerings.

The centrepiece of the platform is the ‘Ultium’ battery, developed jointly with LG-Chem. Ultium has a unique chemistry. Though lithium can still be found at the core of each pouch-like cell, providing power and range, there is a new chemical composition that reduces cobalt in the battery by some 70% compared to GM’s current electric car, the Chevrolet Bolt. The composition of this battery – known as NCMA (Nickel, Cobalt, Manganese, Aluminium) – is constructed into large pouches that reduce the amount of wiring and plumbing compared with a typical battery pack.

These individual battery cells can be placed in a single or double layer, minimising space and maximizing cooling components. They will allow vehicles to achieve (by GM’s estimates) up to a 400-mile range on a full charge, with a 0-60mph time of as little as three seconds. Battery energy storage ranges from 50 to 200 kWh.

The Ultium battery pack can be combined with one to three electric motors of various sizes to power everything from small two-wheel-drive cars to full-size four-wheel-drive pickups. The modular system allows for a flexibility not often seen in electric cars. GM claims that there will be 19 drive unit and battery configurations initially. The combination of Ultium’s unique chemistry and construction and the internally designed electric motors, will allow GM to achieve a price point that will soon approach that of GM’s internal combustion engines.

General Motors has also established up the modular system to be licensed to other entities for an additional revenue stream, taking a page from the startups – and other OEMs.

One of those OEMs, Volkswagen, is already licensing and developing its MEB platform not only for itself, but in conjunction with Ford, which plans to produce at least one electric car on the platform in the European market.

– VAG’s MEB platform for BEVs

So, after years of streaking ahead in technical advances and visionary ideas, electric vehicle startups are now seeing the OEMs with their larger supply chains and abilities to scale eating away at their nimble and new-thinking advantage.

Which leads us back to Bollinger. It appears that the window of opportunity to find a partner or client may be closing soon. But Bollinger at least has a unique product for a strong truck market. Time will tell if this is enough.